At a glance

With SFR from Security Benefit we take away the guesswork with our Investment Choice Management System by Plan ToolsTM.

- Over 50 Investment Options

- Investment Management System with Plan Tools includes:

- Investment Practices Statement (IPS)

- A defined process in place to monitor and select the funds for the plan

- Quarterly Report Cards to show how the funds are doing

- Automatic Fund Mapping to replace underperforming funds

- A streamlined approach to the fund maintenance of the plan

- Automatic Dollar Cost Averaging

- Automatic Rebalancing

- Independent Financial Professionals

Benefits for You and Your Employees

The Investment Practices Statement is a document that outlines the goals of the plan and provides a process for screening and replacing the funds available within the plan. This allows you to be hands off when it comes to investment research and gives you more time to focus on what’s important to your organization.

It’s good for the governance of your plan to have a defined process to keep your plan within specific guidelines. The Department of Labor sets the standard for ERISA plans in terms of best practices so we’ve provided a non-ERISA version of the Investment Policy Statement which we call the Investment Practices Statement.

Quarterly Report Cards and automatic fund mapping ensures that your employees will always have a fund line-up that stays within the guidelines of the Investment Practices Statement.

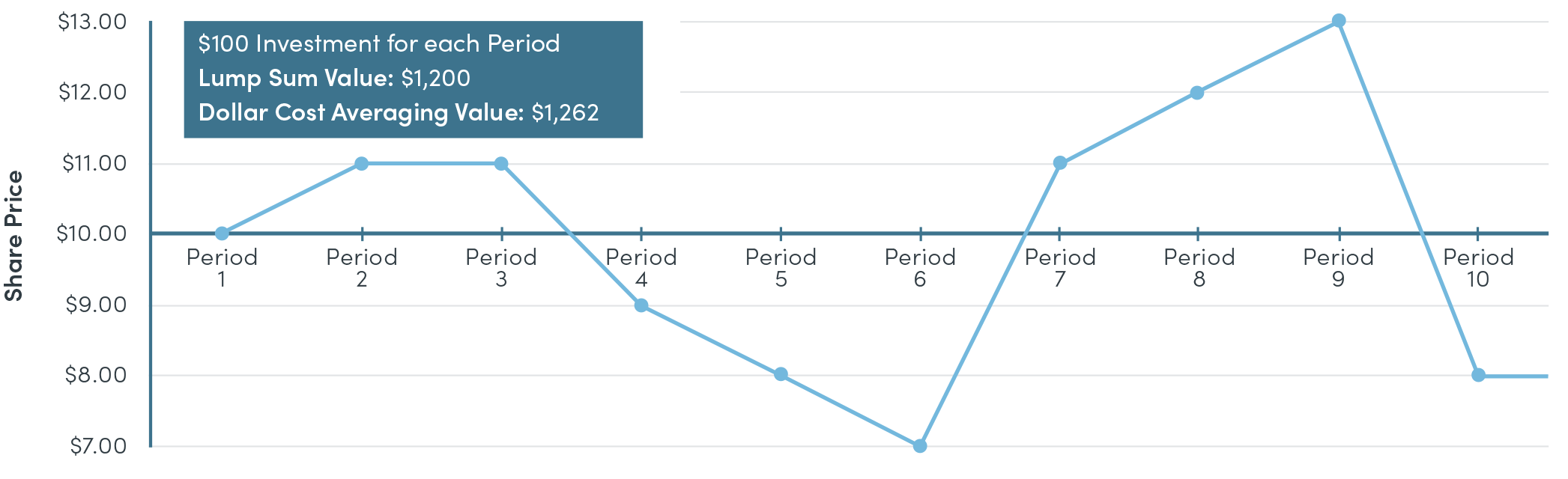

For your employees, we provide Automatic Dollar Cost Averaging which allows your employees to move their previous employer plan accounts to their new plan without putting all of their money into the market at once. While dollar cost averaging does not guarantee a specific return, it is proven to be a powerful way to take advantage of market fluctuations. Consolidating accounts can also help your employees streamline the management of their assets more efficiently over the long term.

Dollar Cost Averaging — Mixed Market

Automatic rebalancing helps your employees’ portfolios stay within their risk tolerance when specific investments grow more quickly than others. It’s an easy way to help your employees take advantage of buying low and selling high, just a part of our streamlined process.

Security Benefit works only with independent financial professionals which allows you as the employer to choose who you want to work with for your plan. The advantage of working with an independent financial professional is that they will put you and your employees’ interests first.

Designed specifically for employers, SFR Program is a group retirement plan that provides flexible plan administration, complete customer service, a risk-management program, as well as comprehensive participant education and guidance. The program provides employers the ability to offer their employees a variety of mutual fund choices and a "Fixed Account" option.

For more information, contact your financial professional or call us at 800.747.5164 option 3.

1 The Investment Management System with Plan Tools is not available for Solo 401(k) plans.