At a glance

How can Foundations, a fixed index annuity, help diversify your client's portfolio?

Foundations Annuity can help diversify and de-risk a portion of your client's retirement portfolio by offering participation in market-linked performance, without any market downside risk.

- Clients get a head start with a 1% Bonus on 1st-yr purchase payments

- Flexible premiums; surrender charge period doesn't reset for added funds

- Diverse lineup of index accounts, as well as a guaranteed Fixed Account

- 10% Free Withdrawals after 1st contract anniversary

- Non-qualified stretch option for legacy planning

- Upfront and trail commission options

Foundations offers a range of index-linked strategies based on diverse asset classes. These strategies can spread out your client's potential for accumulation, without the risk of traditional investments.

Use the table below to explore the indices available in Foundations and their performance.

| Indices | Index Crediting Strategies |

S&P 500® | Annual Point to Point with Cap |

| Annual Point to Point with Trigger Rate | |

| Annual Average | |

| Monthly Sum | |

MSCI EAFE Index (International Equities) | Annual Point to Point with Cap |

Nasdaq-100 Index® | Annual Point to Point with Cap |

Russell 2000® Small Cap Index | Annual Point to Point with Cap |

S&P 500 Factor Rotator Daily RC2 7% Index | Annual Point to Point with Participation Rate |

| 2-yr Point to Point with Participation Rate | |

S&P 500 Low Volatility Daily Risk Control 5% Index | Annual Point to Point with Annual Spread |

| 2-yr Point to Point with Annual Spread | |

S&P 500 Multi-Asset Risk Control (MARC) 5% Index | Annual Point to Point with Participation Rate |

| 2-yr Point to Point with Participation Rate | |

Morningstar Wide Moat Focus Barclays VC 7% Index | Annual Point to Point with Participation Rate |

| 2-yr Point to Point with Participation Rate |

Foundations Resources

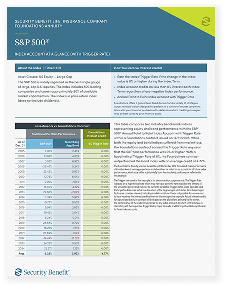

| NEW! S&P 500 Trigger Rate StrategyUse this piece to explain how the Trigger Rate strategy provides a predetermined interest credit with S&P 500 performance of 0% or greater.

| |

| For additional Foundations materials, visit our Foundations Resource Page. |

Before Selling Foundations

- Check with your Broker-Dealer to see if Foundations is approved

- Get Appointed with Security Benefit

- Complete Product Training

For more information (including financial professional fact sheets and resources), contact your dedicated Sales Team.

We’re here to help your clients To and Through Retirement®.