At a glance

Nearing or being in retirement is not the time to risk your clients' savings.

Are your clients worried about savings protection as they near retirement? With ClearLine Annuity, they can enjoy growth without fear of market downturns.

ClearLine Annuity Benefits:

- Accumulation Potential With Protection: Earn interest credits tied to the financial market index without exposing the principal to the market risk.

- Flexible Allocation Options: Choose from a Fixed Account and eight index crediting strategies designed for stability and interest potential.

- No Surrender Charges: Access contract value anytime without early withdrawal penalties.

Help secure your clients' futures with ClearLine Annuity--a smart choice for risk-averse clients seeking both accumulation and protection. They can build retirement savings with confidence and peace of mind.

Exclusive Access for DPL Members

ClearLine Annuity is only available through DPL Financial Partners, providing RIAs with commission-free annuity solutions. Interested in learning more about becoming a member? Contact DPL: 888.327.0049

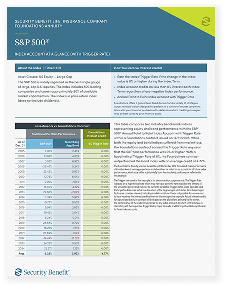

| NEW! S&P 500® Trigger Rate StrategyUse this piece to help your clients understand how the trigger rate strategy can offer the potential for higher interest credits if the S&P 500® performs well enough to reach a predetermined "trigger rate".

|

| Benchmarked Indices | Index Crediting Strategies |

S&P 500® | Annual Point to Point with Cap |

| Annual Point to Point with Trigger Rate | |

| Monthly Sum | |

MSCI EAFE | Annual Point to Point with Cap |

Nasdaq-100® | Annual Point to Point with Cap |

Russell 2000® Small Cap | Annual Point to Point with Cap |

S&P 500 Low Volatility Daily Risk Control 5% | Annual Point to Point with Spread and Participation Rate |

| 2-Year Point to Point with Spread | |

Avantis Barclays Volatility Control | Annual Point to Point with Participation Rate |