At a glance

How do I diversify my retirement account1?

- Over 155 mutual funds

- 30 different asset classes

- 31 different investment firms

- Diversification without the need of a brokerage account

- Low account minimums to get started

- Consolidation of accounts made easy with Automatic Dollar Cost Averaging

With the Security Benefit Advisor Mutual Fund Program you have over 155 investment options to choose from and three options to help create a portfolio that’s right for you. You can work with a local independent financial professional who can help make one of three investment choices:

- Choose a Target Date Fund by selecting a fund closest to your retirement date

- Build your own portfolio with over 155 different mutual funds

- Choose a lifestyle fund that is closest to your risk tolerance and retirement goals

Retirement Plan Rollovers

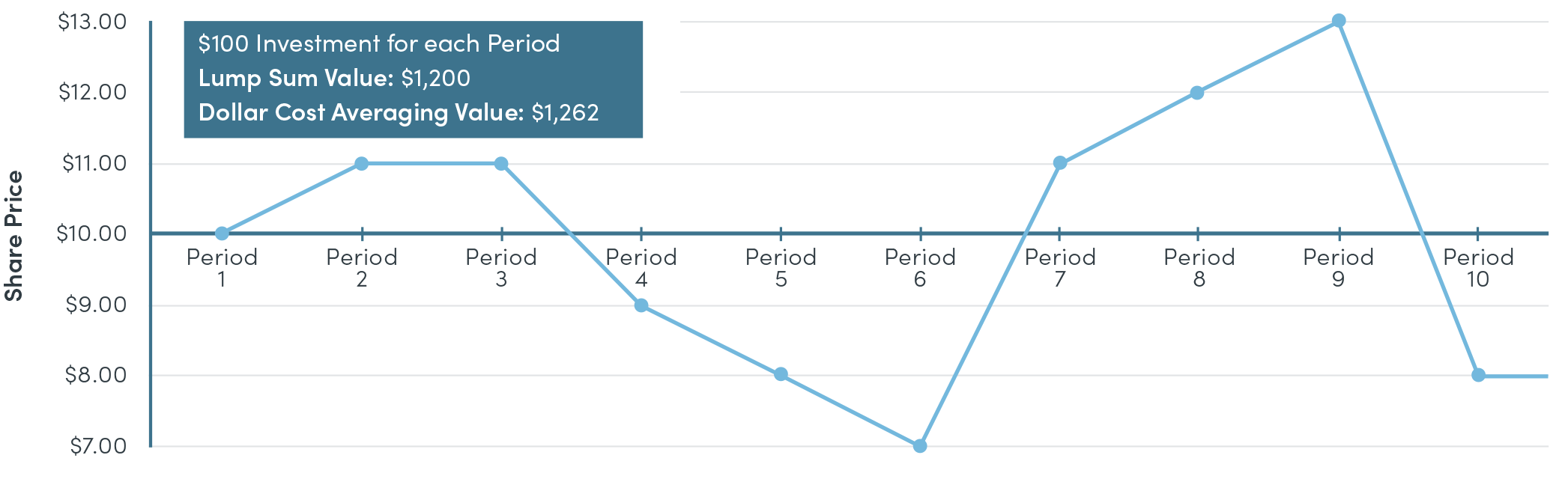

Do you want to rollover your retirement plan from a previous employer? Automatic Dollar Cost Averaging may help you manage risk when you rollover your account from a previous employer. With Advisor Mutual Fund Program you can spread out your entry into the market over a period of time versus placing all of your money into the market at once. Dollar Cost Averaging allows you to purchase shares of investment options at different prices instead of buying into the market all at once at the same price.

Dollar Cost Averaging is powerful and happens automatically when you make contributions from your paycheck into your retirement plan or monthly through automated contributions for IRA’s. This gives you the opportunity to purchase shares at lower prices during market downturns.

The Top 3 Ways to Optimize Your Retirement Savings

- Align your portfolio with your investment goals

- Contribute as much as you can as soon as you can

- Take the time to review your portfolio and investments on a yearly basis

Taking Loans on Retirement Accounts

It’s no secret that millions of Americans have not saved enough for retirement. If you have a 403(b) account, loans are available on your account but it’s important to know that you should only use the loan as a last resort. While retirement may seem like a long time from now, most people find themselves trying to plan for it at the last minute, instead of taking a long term approach. It’s easy to say that you will just work longer. However, it’s important to know that some events are out of our control and health issues, whether it’s you or a family member can prevent you from working longer.

Security Benefit has the choices, tools, and knowledge to help you plan for a fruitful retirement.

You can take out a loan to buy a car, go to college, or purchase a house but you can’t take out a loan to finance your retirement.

Contact your financial professional or call our Service Center at 800.888.2461 to get started today.

1Diversification does not assure a profit.