This Index is designed to track the performance of a risk-weighted portfolio consisting of three asset classes:

- Equities: S&P 500® Excess Return Index

- Commodities: S&P GSCI Gold Excess Return Index

- Fixed Income: S&P 10-Year U.S. Treasury Note futures Excess Return Index

This Index provides multi-asset diversification within a simple risk weighting framework. Should one or more of the markets experience a downturn which impacts the performance of a specific asset class, the multi-asset construction of the index allows for a systematic re-balancing to less volatile asset classes. If all asset classes are volatile the risk control also allows for reducing market exposure and increasing the allocation to interest free cash.

In order to take advantage of potential market growth, the Index may allocate more than 100% to the component indices. Should the component indices experience market declines, the Index can move a greater portion to interest free cash while still targeting 5% volatility.

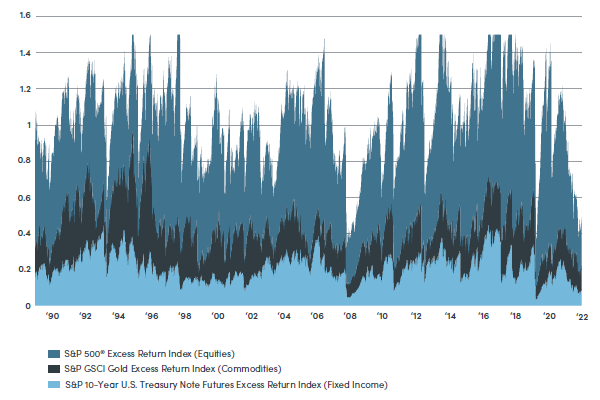

S&P MARC 5% Index Allocation Mix

The graph below shows the Index allocation for the time period shown.

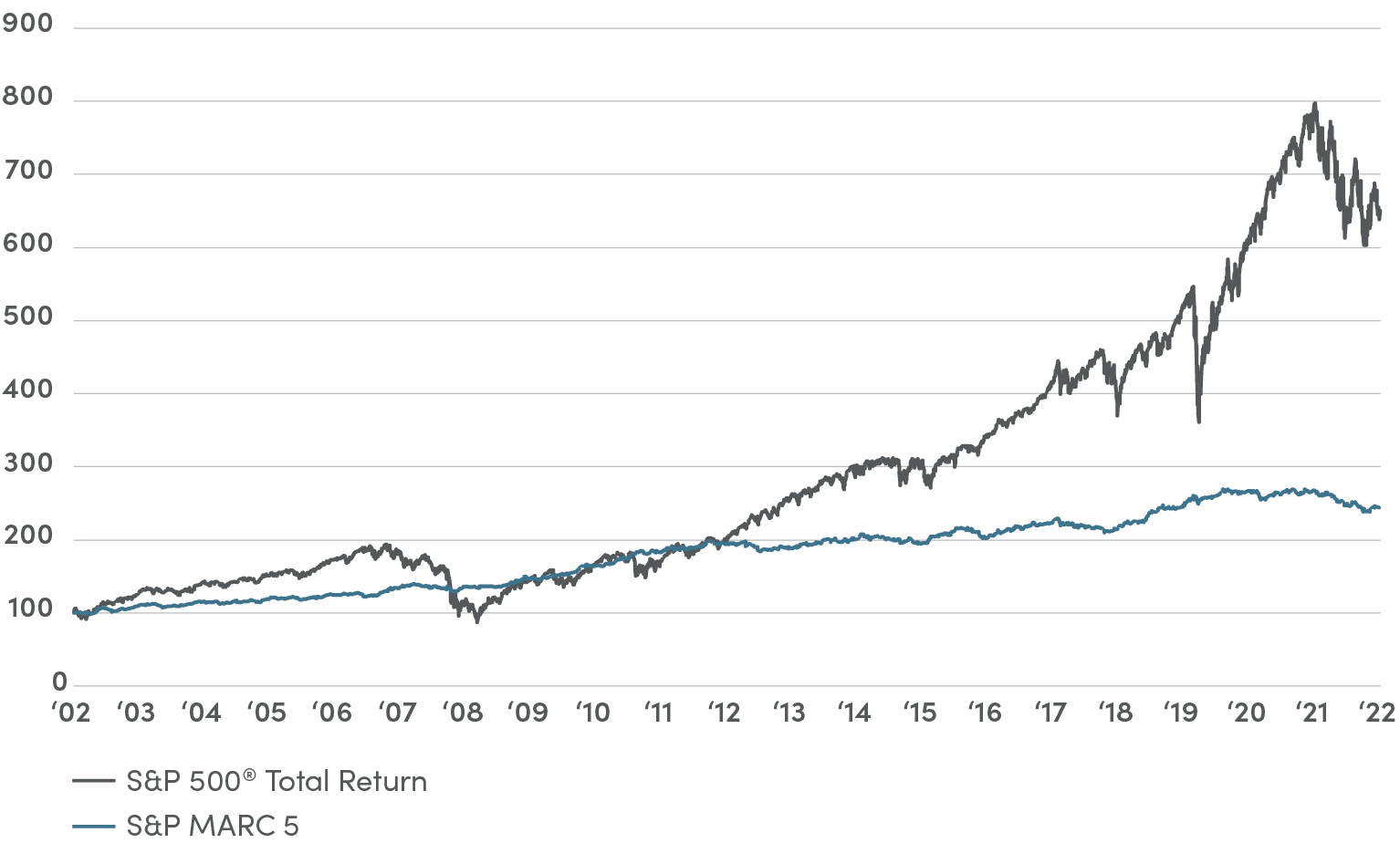

S&P MARC 5% Index Historical Performance

The graph below shows the Index performance of the S&P MARC 5% Index compared to the S&P 500® Index, indexed to the same beginning value, in this case 100.

Watch this video to learn how the S&P MARC 5% Index is constructed.

|

SELLING FOUNDATIONSThe first steps in selling Foundations:

FIAs don’t have to be complicated, and with Foundations, we’ve created content to help make it easier to educate your clients on how the product works, from client-friendly presentations to sales ideas. Use the resources linked below to start conversations with your clients. |