Did you know many states have passed legislation requiring small businesses to provide retirement programs for their employees?

In the states where this legislation has passed, employees can access a state-run retirement program or the employer must offer an alternative retirement plan. In most cases, the states sponsor the plans themselves or automatically deposit payroll deductions into IRAs or other accounts. Generally, employees are automatically enrolled if their employer does not offer plan options.

Almost 60% of business owners who don't offer an employee retirement plan think providing their own plan would be more attractive than a state-mandated program.1

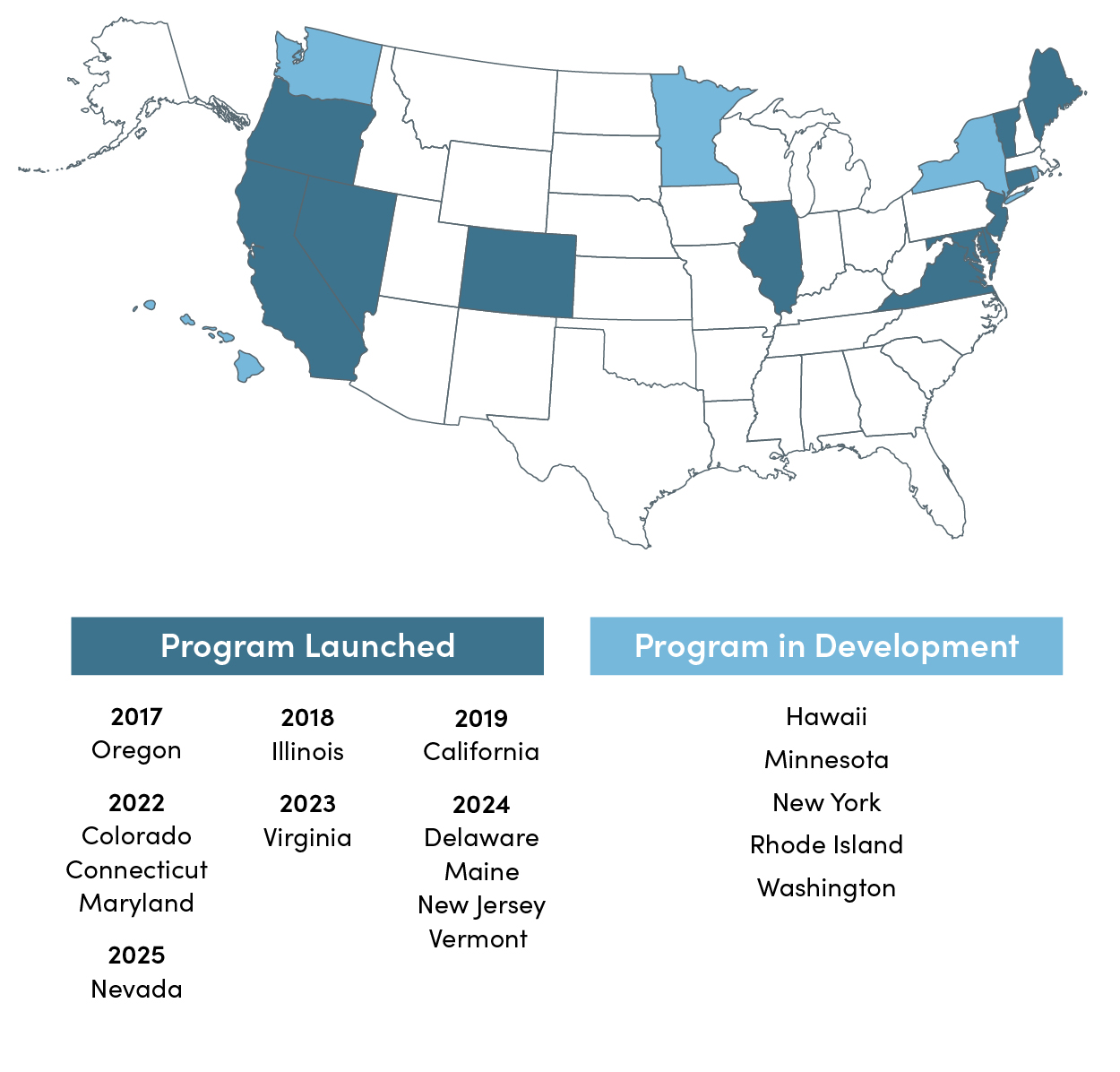

State-Mandated Retirement Savings Programs Snapshot 2

Help Your Small Business Clients Find the Best Retirement Plan Solution for Their Employees

Many state retirement plans take a one-size-fits-all approach. This is a unique opportunity to work with small business owners on tailoring a retirement plan solution that fits their needs and provides a better option for their employees.

The Security Benefit SIMPLE IRA is a smart solution for business owners looking for an easy and flexible retirement plan for their employees.

The SIMPLE IRA is a great fit for small business owners who want:

- Less administrative responsibilities than a 401(k)

- Easy set up and maintenance

- Additional benefits to attract and retain quality employees

A SIMPLE Solution for Small BusinessesA Security Benefit SIMPLE IRA offers you turnkey sales support to reduce your administrative workload, while providing your small business clients an easy way to provide a retirement plan for their employees. Not only are SIMPLE IRAs, well simple, they are inexpensive and straightforward to set up. |