Your clients can choose from a fixed account as well as five diverse crediting options to provide them with safety and the potential to receive interest for their contracts based in part on the performance of either the S&P 500® Index or the S&P 500® Low Volatility Daily Risk Control 5% Index.

Some Market Participation. No Market Downside.

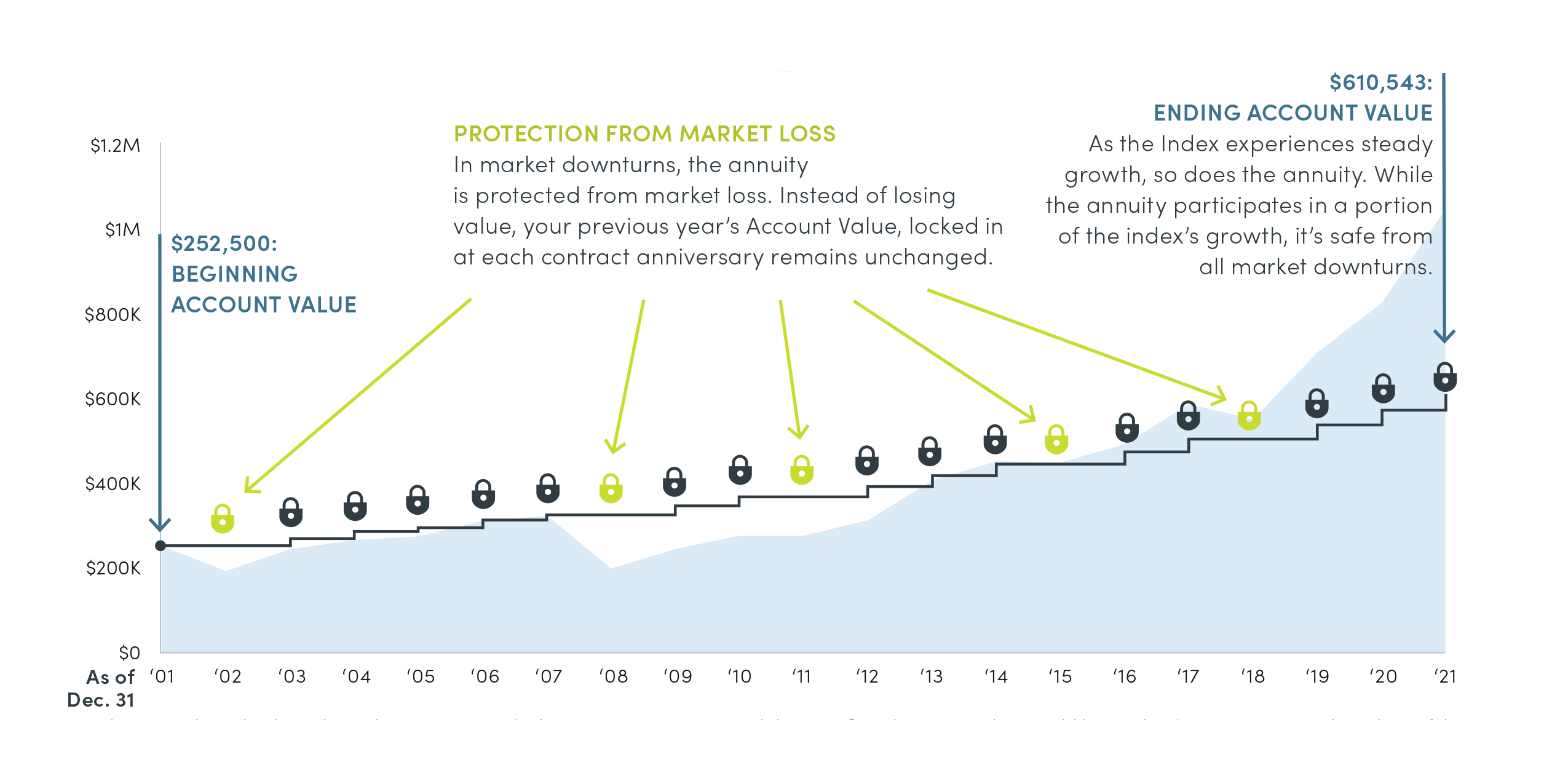

Here’s an example of how the S&P 500® Annual Point to Point Index Account, with a 4.75% cap applied, Foundations can help protect and grow your clients’ account value (assuming the contract was purchased on Dec. 31, 2020):

The example makes hypothetical assumptions, which are not a guarantee and do not reflect the interest that would be credited to your annuity. The values of the S&P 500® Index are actual values for the periods shown. The Foundations Annuity was not available until September 2012 and is not reflected in this example. The hypothetical interest calculations are based upon assumptions on the cap applied in computing Annual Point to Point Index Account interest credits. Different caps and different index crediting accounts may produce significantly different results. The hypothetical values assume no withdrawals and no additional Purchase Payments. All returns shown are cumulative and not on an annualized basis. Withdrawals are subject to ordinary income tax and if made before age 59½, may incur a 10% IRS penalty tax and may be subject to product-specific charges.

To learn more about all the crediting strategies within Foundations, read our product brochure.

Not available in New York.