Build an investment portfolio tailored to your client’s risk profile and financial goals from nearly 90 well-known underlying funds.

SecureDesigns offers investment options from some of the industry’s most highly regarded money managers. This expertise can help diversify your client’s investment portfolio according to their unique wealth accumulation objectives and risk tolerance — from conservative to aggressive.1

You can choose to manage those assets on your own, or work with a third party investment adviser firm to help achieve your clients’ financial goals.

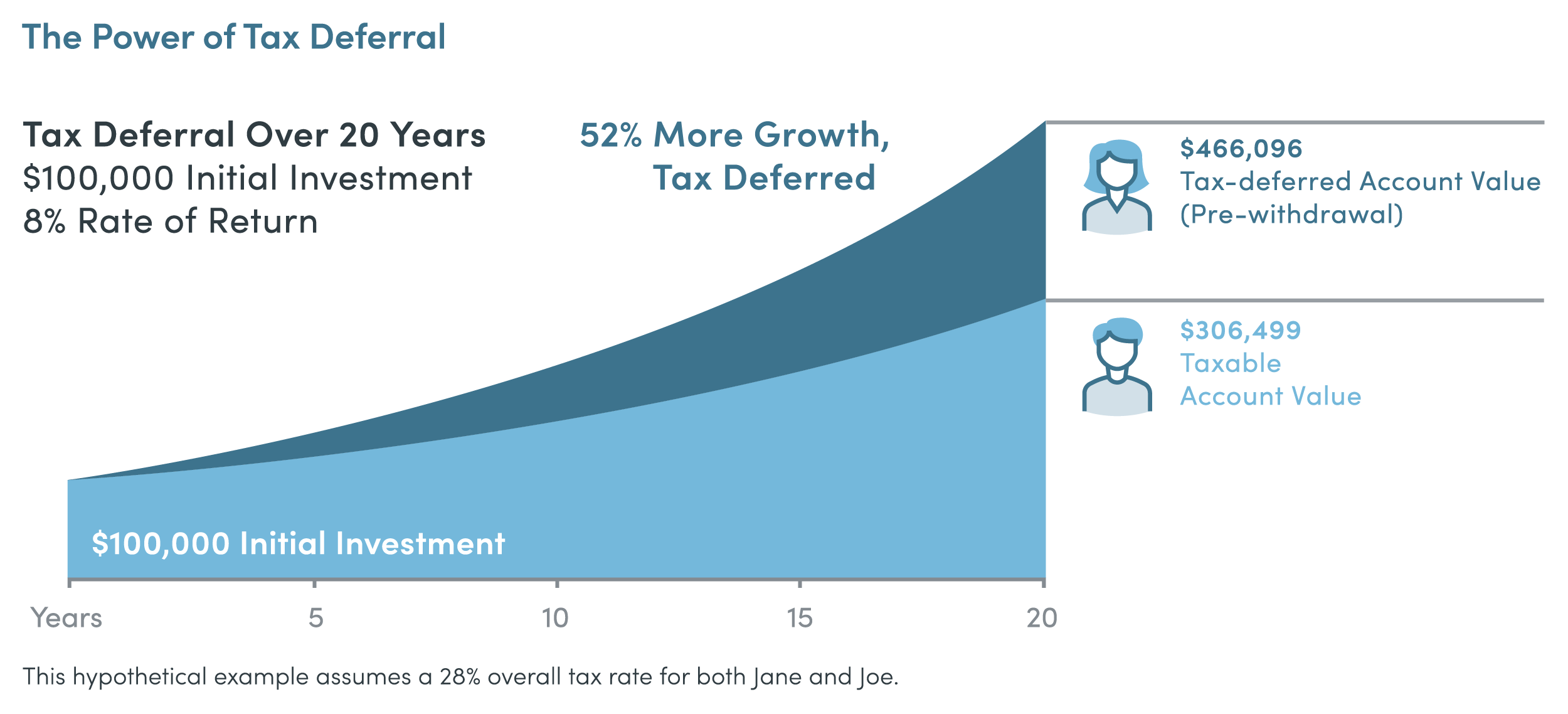

The Power of Tax Deferral

Below is an example of how a tax-deferred portfolio can help accumulate wealth faster than a similar portfolio that’s been taxed along the way. The graph below shows 52% more growth on a tax deferred portfolio over a taxable portfolio.

SOURCE: Security Benefit, January 25, 2019. The example above assumes an initial investment of $100,000 with investment earnings of 8% and a federal income tax rate and short-term capital gains tax of 24% and does not reflect the effect of any state taxes. These returns are hypothetical and in no way relate to the actual performance of any investment. The investment return on any particular product may differ substantially. Tax rates and tax treatment of earnings may impact comparative results. The example does not reflect the deduction of any M&E, administration or fund expenses. If such fees were deducted, the values illustrated would be reduced. It is important to note that while taxes on amounts invested in an annuity are deferred until withdrawn, upon withdrawal, tax-deferred performance would be reduced by income taxes on gains. Withdrawals are subject to ordinary income tax and, if made prior to age 59½, may be subject to a 10% IRS penalty tax. Conversely, earnings from investments that do not offer tax deferral are taxed currently, and withdrawals from such an investment are not subject to the penalty tax. Lower maximum tax rates on capital gains and dividends would make the return of the taxable investment more favorable, thereby reducing the difference in performance between the accounts shown. Some situations such as your personal investment horizon and income tax brackets (both current and anticipated), changes in tax rates and tax treatment of investment earnings may impact the results of this comparison. Each person’s situation is different, so these and other considerations must be taken into account when making an investment decision. For illustrative purposes, an income tax and short-term capital gains tax rate of 24% has been used; however, a person’s tax rate will likely change over the course of a 20-year period.

Clients can customize their annuity.

Everyone’s financial situation is unique. SecureDesigns lets your clients tailor the product to fit their financial needs and risk profile.

As an investment-oriented variable annuity, your clients benefit from the contract’s low cost and diverse investment options. But, they still have optional benefits and features to choose from at an additional cost, including:

- Annual stepped up death benefit

- 4% Extra Credit Enhancement

- Waiver of Withdrawal Charges for unexpected hardships (nursing home; disability, terminal illness)

- Shorter Withdrawal Charge periods2

For more information about SecureDesigns, call our Sales Support Team at 800.747.5164, option 3.

1Diversification does not assure a profit.

2The Nursing Home Waiver is not available in California and Massachusetts, and the Terminal Illness Waiver is not available in California and New Jersey.