Every four years, the United States goes through the rigors of a presidential election. As campaigns ramp up and debates heat up, a sense of uncertainty often grips the nation, particularly within the financial markets. Investors, both seasoned and new, often find themselves wondering how the outcome of an election might affect their portfolios.

Historical Perspective on Market Performance

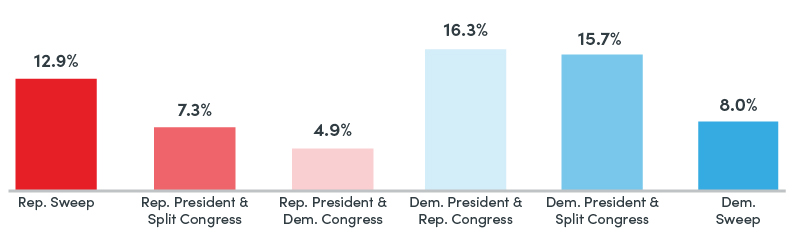

The stock market has shown resilience and growth over the long term, regardless of which party controls the White House. Since 1953, which marks the beginning of Dwight D. Eisenhower's presidency, the average annual returns of the S&P 500® under different party controls have proven resilient1.

Average Annual S&P 500® Returns since 1953 by Party Control1

Regardless of which party wins, the S&P 500® has generated an average gain of 7% during presidential election years2.

Election Cycle Gains for Stocks Historically

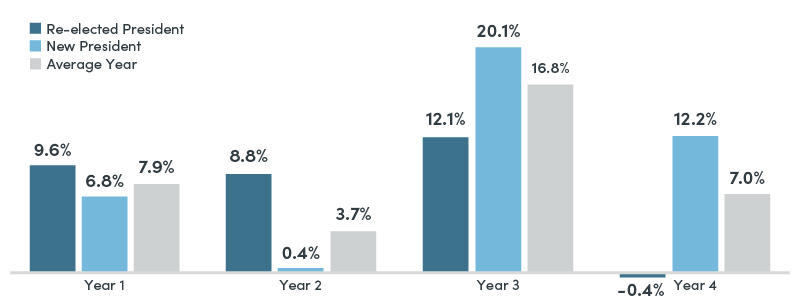

It's common for markets to experience short-term volatility around election periods. This volatility is often driven by uncertainty and speculation about potential policy changes. However, once the election results are in and policies start to take shape, the markets typically adjust and stabilize.

S&P 500® Index Returns Based on 4-Year Presidential Cycle2

While it's natural to be concerned about how presidential elections might impact your investments, historical data and market fundamentals suggest that long-term investors should maintain a steady course.

The market has grown and proven resilient under both Republican and Democratic administrations. By focusing on economic fundamentals, staying diversified, and avoiding the temptation to make drastic changes based on short-term political events, you can continue to grow your retirement savings and achieve your financial goals.

Talk to your financial professional to learn more or contact us at 800.888.2461.

Additional Topics

What are annuities?Annuities can be a beneficial tool that can ensure a stable and predictable income stream in retirement. See if they're right for you. |

Navigating Retirement Goals Through Life StagesMaking the right choices at the right times of your life can help you achieve your retirement aspirations. |

1RBC Wealth Management, Bloomberg data through 12/31/2023; data based on price returns (does not include dividends).

2LPL Research, FactSet 12/05/2023 (1950-2022).