As you near or enter retirement, you must make several financial decisions that will affect how far your savings will stretch. One of the most critical is how you’ll pay for health care, even with Medicare coverage.

What is Medicare?

Medicare is a federal health insurance program primarily designed for individuals aged 65 and older, though it also covers certain younger people with disabilities and those with End-Stage Renal Disease (ESRD).

Understanding the basic structure of Medicare is the first step in maximizing your benefits.

Parts of Medicare

Medicare is divided into four main parts, each covering different aspects of healthcare:

- Medicare Part A (Hospital Insurance): Covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and home health care.

- Medicare Part B (Medical Insurance): Covers certain doctors' services, outpatient care, home health services, medical supplies, mental health services, and preventive services.

- Medicare Part C (Supplemental Insurance): An alternative to Original Medicare (Parts A and B) offered by private insurance companies approved by Medicare. These plans often include additional benefits such as vision, dental, and prescription drug coverage.

- Medicare Part D (Prescription Drug Coverage): Provides prescription drug coverage through private plans that contract with Medicare.

How Does Medicare Part C Supplement Your Coverage?

Medicare Part C is a Medicare Supplement Policy. Medigap and Medicare Advantage Part C plans are offered by Medicare-approved private companies. They can help you pay for some of the remaining healthcare costs and services that Medicare doesn’t cover.

A Medicare Advantage plan is required to provide all Medicare Part A and Medicare Part B benefits. Most plans offer additional benefits like dental or vision coverage, health club memberships, medical transportation, or coverage for hearing aids and other things typically covered by a Medigap plan.

Eligibility and Enrollment

To be eligible for Medicare, you must be 65 years or older, under 65 with certain disabilities or conditions such as permanent kidney failure. Those receiving Social Security or Railroad Retirement Board benefits for at least four months before age 65 will be automatically enrolled in Original Medicare Parts A and B. Otherwise, you will apply online, by phone, or by visiting your local Social Security office.

Enrollment periods are critical in ensuring you get coverage without penalties:

- Initial Enrollment Period (IEP): Starts three months before you turn 65 and ends three months after the month you turn 65.

- General Enrollment Period (GEP): Runs from January 1 to March 31 each year for those who missed their IEP.

- Special Enrollment Period (SEP): Available for individuals who qualify due to specific circumstances, such as losing employer coverage. If eligible, you would not pay a late enrollment penalty.

- Annual Election Period: Also known as Fall Open Enrollment, you can make changes to your Medicare coverage during this period. Runs from October 15 through December 7, with your new coverage starting January 1.

Tips for Maximizing Your Medicare Benefits

- Review Your Needs Annually: Medicare plans can change each year, and so can your health needs.

- Consider Total Costs: Look beyond premiums and consider deductibles, copayments, and out-of-pocket limits when choosing a plan.

- Use Preventive Services: Medicare offers many preventive services at no cost. Take advantage of screenings, vaccines, and wellness visits.

- Check for Extra Help: If you have limited income and resources, you may qualify for programs that help pay Medicare premiums, deductibles, and coinsurance.

- Understand Your Rights: Be aware of your rights and protections under Medicare, including the right to appeal decisions about coverage or payment.

Medicare Part D

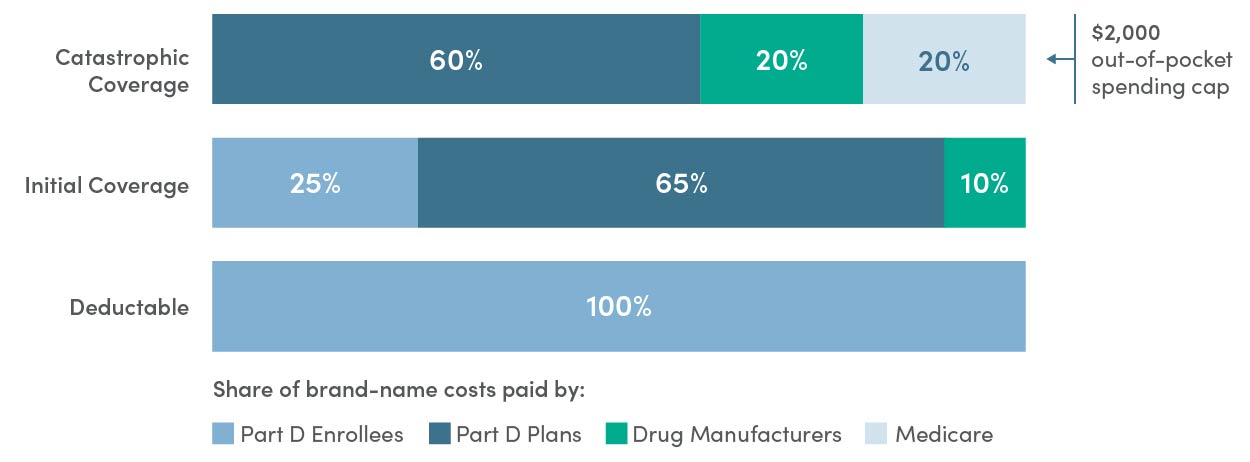

Starting in 2025, all Medicare plans include a $2,000 cap on out-of-pocket prescription costs for covered Part D drugs. If you reach the $2,000 spending limit, you will automatically receive "catastrophic coverage," which means you won't pay out-of-pocket for drugs covered by Part D.

This benefit includes a deductible, an initial coverage phase, and catastrophic coverage. Once Part D enrollees have paid their deductible, they will then enter the initial coverage phase where they will pay 25% of their drug costs. Once the enrollee has paid $2,000 out-of-pocket, the catastrophic coverage will begin and no additional out-of-pocket costs will be required.

Download our Medicare brochure for more information on Part D and other benefits of Medicare.

By understanding the intricacies of Medicare and regularly reviewing your options, you can maximize your benefits and ensure you receive the care you need. Stay informed and proactive about your healthcare choices to make the most out of your Medicare coverage.

Additional Topics

Navigating Retirement Through All Stages of LifeMaking the right choices at the right times of your life can help you achieve your retirement aspirations. |

Your Guide to RolloversThe money in retirement plan may be one of your largest single assets, but when it comes time to retire or leave your employer, what will happen to your retirement plan assets? |