As we journey through our careers, retirement can often feel like a distant dream. However, by implementing strategic life stage investing, we can transform those aspirations into tangible realities. Whether you're just starting in your career, midway through, or nearing retirement, there are actionable steps you can take to secure your financial future.

Early Career: Planting the Seeds for Future Growth

In the first stages of your career, laying a solid financial foundation is key. While retirement may seem far off, the power of compounding works best when given time to flourish. Here are some action steps for early career professionals:

- Establish an Emergency Fund. Start by setting aside three to six months' worth of living expenses in an accessible savings account. This safety net will provide peace of mind and protect you from unexpected financial setbacks.

- Contribute to Retirement Accounts. Take advantage of pretax contributions to employer-sponsored retirement plans such as 401(k)s or 403(b)s, especially if your employer offers a matching contribution. Aim to contribute at least enough to get the full match – it's essentially free money! By making pretax contributions to a tax-deferred savings plan, a $100 contribution only feels like a $76 contribution because it's pretax. How can you know if you are saving enough? Our savings calculator can help with your plans.

- Diversify Investments. While you have time on your side, consider investing in a mix of stocks, bonds, and other asset classes. Diversification can help spread risk and enhance long-term returns. (Diversification does not assure a profit or insure against financial loss.)

- Educate Yourself. Take the time to learn about investing basics, such as asset allocation, risk tolerance, and the power of compound interest. Resources like books, online courses, and financial professionals can offer valuable guidance.

Mid-Career: Building Momentum Towards Retirement

As you progress in your career, your financial responsibilities may grow, but so do your earning potential and investment opportunities. Here's how mid-career professionals can continue to build towards retirement:

- Maximize Retirement Contributions. Increase your contributions to retirement accounts as your income grows. You may want to increase your plan contributions by a percentage or two each year and review your portfolio annually to assess allocations based on your personal level of risk or changing life circumstances. Aim to max out your annual contributions to take full advantage of tax-deferred growth opportunities.

- Reassess Risk Tolerance. As retirement draws nearer, consider adjusting your investment portfolio to reflect your changing risk tolerance and time horizon. This may involve gradually shifting towards more conservative investments to protect accumulated wealth.

- Explore Additional Investment Vehicles. Look beyond employer-sponsored retirement plans and explore other tax-advantaged accounts such as IRAs (Traditional or Roth), health savings accounts (HSAs), or taxable brokerage accounts. Each offers unique benefits and can complement your overall investment strategy.

- Plan for Major Expenses. Anticipate major life events such as buying a home, funding education for children, or caring for aging parents. Incorporate these expenses into your financial plan to ensure they don't derail your retirement goals.

Late Career: Nearing the Finish Line

As retirement approaches, it's time to fine-tune your financial plan and make any necessary adjustments to ensure a smooth transition. Here are some steps for late-career professionals:

- Review Retirement Readiness. Assess your retirement savings, projected expenses, and income sources to decide if you're on track to meet your retirement goals. Consider consulting with a financial professional for a comprehensive retirement plan review. Understand your options and the financial rewards and risks associated with them.

- Protect Against Market Loss. If you’re concerned about the risk of negative market returns occurring late in your working years, you may consider a fixed index annuity which provides tax deferral, guarantees against the loss of principal due to market downturns, the potential for credited interest, and the reassurance of a death benefit for beneficiaries.

- Maximize Social Security Benefits. Understand your options for claiming Social Security benefits and strategize the best timing based on your circumstances. Delaying benefits can result in higher monthly payments in retirement.

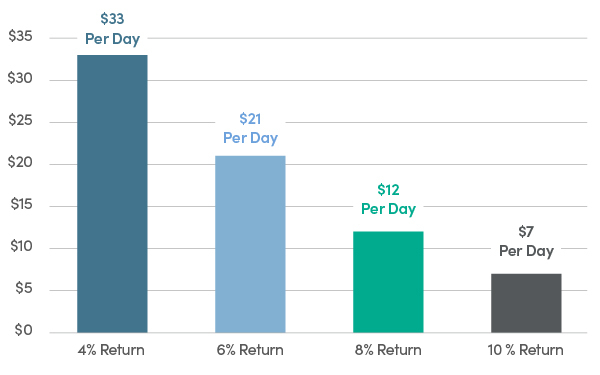

- Create a Sustainable Withdrawal Strategy. Develop a systematic withdrawal plan for tapping into your savings during your retirement years. The 4% rule is a commonly used guideline, but your withdrawal strategy should be tailored to your specific needs and market conditions. Consult your financial professional on the withdrawal strategy that meets your goals.

By following these actionable steps at each stage of your career, you can proactively manage your finances and work towards achieving your retirement aspirations. Remember, the journey to retirement is a marathon, not a sprint. With careful planning, discipline, and patience, you can navigate the complexities of life-stage investing and enjoy a financially secure retirement.

Talk to your financial professional to learn more or contact us at 800.888.2461.

Additional Topics

What are Annuities?Annuities can be a beneficial tool that can ensure a stable and predictable income stream in retirement. See if they're right for you. |

Retirement Challenges for WomenWomen face unique retirement challenges that differ from those of men because they typically live longer, have less time to save, and continue to face a wage gap. |