Is it better to convert in 2025 or wait until 2026 or later?

With the 2017 Tax Cuts and Jobs Act (TCJA) scheduled to sunset after 2025, many individuals are evaluating the timing for Roth conversions. When the TCJA expires, tax rates are set to revert to higher levels, which may be a reason there has been an increased interest in converting traditional IRAs and 401(k)s to Roth accounts. Roth conversions involve paying taxes upfront, but the long-term benefit is tax-free growth and withdrawals in retirement.

Why Consider a Roth Conversion Now?

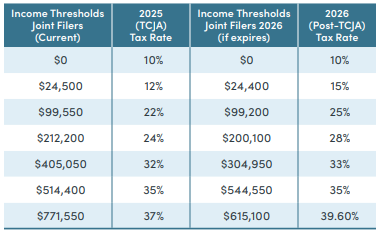

- Pay taxes at today’s lower rates: The TCJA reduced income tax rates across most brackets. When the TCJA expires in 2026, rates will increase, meaning your tax bill will be higher if you wait to convert.

- Tax-free growth and withdrawals: A Roth IRA grows tax-free after conversion, and, once you are retired, qualified withdrawals are tax free, saving you a lot of money over time.

To illustrate, compare the current tax rates with those projected once TCJA expires in 2026:

Why the Rush on Roth?

Recent reports indicate there has been a significant increase in the amount of Roth conversions. Why? If you convert before 2026, you will pay taxes based on the current TCJA rates. After 2026, you might face higher tax rates on the same amount converted. By converting now and paying taxes at today’s lower rates, savers can permanently remove a future tax burden – even for those who might inherit their Roth IRA.

Is 2025 the Right Year for You?

For people with traditional retirement accounts, 2025 could be a great chance to convert at lower tax rates. The best timing for you depends on:

- Your income: Will this conversion increase your income and push you into a higher tax bracket?

- Your retirement plans: Do you expect to be in a lower tax bracket after you retire?

- Healthcare costs: Roth conversions increase your taxable income in the year you convert, which can impact Medicare premiums (known as IRMAA surcharges).

- State taxes: Most states handle Roth IRA conversions similarly to the IRS, but there are important differences to consider.

What’s Next?

If 2025 is your year to convert, talk to a financial advisor or tax professional for personalized advice. If you’re still deciding, explore our additional Roth IRA conversion resources below.

Converting now could save you and your heirs money in the long run, but careful planning is the key.

Should You do a Roth Conversion?Use this Roth Conversion calculator to estimate if converting now or later would be better. | Want to Know More?Take a deep dive into what you should know about Roth conversions. |