RateTrack® Annuity could be a good complement to your portfolio to help you meet financial goals and fulfill your retirement aspirations.

A few advantages of RateTrack® Annuity:

- Potential to receive higher interest rates automatically if rates rise during your contract Guarantee Period

- Interest that compounds tax free until withdrawal1,2

- Ability to access a portion of your funds without penalty3,4

- Ability to access some or all of your money in the event of nursing home confinement or terminal illness1,3

- Death benefit

How does RateTrack® Annuity work?

RateTrack® Annuity launched in March 2016 as the industry’s first floating rate annuity.

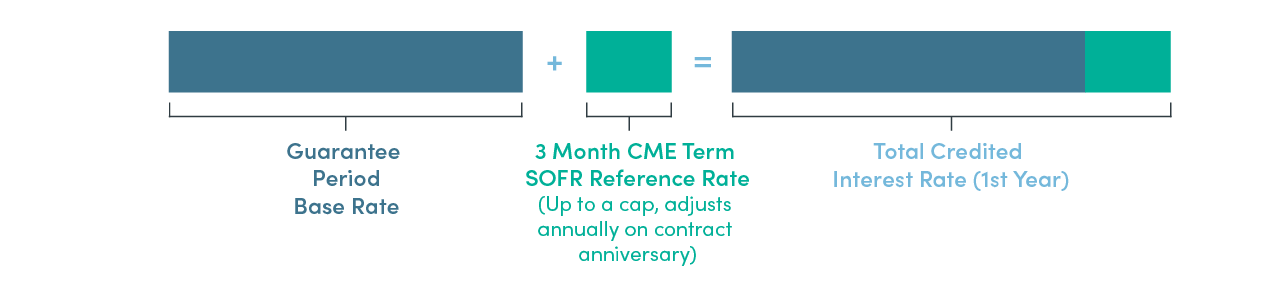

During the RateTrack® Annuity’s Guarantee Period (5 or 7 years), interest is calculated and credited on the combination of a fixed interest rate — the Guarantee Period Base Rate — and a floating rate based on the 3 Month CME Term SOFR Reference Rate.

Although some bond funds may increase when interest rates rise, bond prices and interest rates usually have an inverse relationship. As rates rise, bond values fall, and vice versa. A floating rate annuity like RateTrack® Annuity is not correlated to the market and could be something to consider as part of your retirement savings strategy.

Talk to your financial professional to see whether RateTrack® Annuity can complement your retirement portfolio.

1Withdrawals are subject to ordinary income tax and, if made before age 59½, may be subject to a 10% penalty tax.

2Each Guarantee Period has its own surrender charge schedule. Early withdrawals in excess of the free withdrawal amount are subject to a surrender charge unless the withdrawal is pursuant to the Nursing Home Waiver or Terminal Illness Waiver.

3Nursing Home Waiver is not available in CA and MA, and Terminal Illness Waiver is not available in CA and NJ. Other state variations may apply.

4After the 3rd Contract Anniversary, any request to waive surrender charges must be made on forms provided by Security Benefit Life Insurance Company (SBL) and must be accompanied by a physician's statement. Refer to the contract for details. Not available in all states.