At a glance

How do I choose the right investment options for my employer retirement plan?

- Low-cost Target Date Funds

- Low-cost Vanguard Index Funds

- Streamlined Enrollment

- 59 Investment Options

- Automatic Dollar Cost Averaging

With our Workplace Retirement Plan, Security Benefit gives you 59 investment options to choose from and three options to help you pick the right investment options.

We offer a simple option with low cost Vanguard Target Date Funds. It’s simple. You can choose the fund with the date that’s closest to the year that you think you will retire. A Target Date Fund automatically adjusts the allocation of the fund to be more conservative as you near retirement.

We have low cost core Vanguard Index Funds with model portfolios that you can choose by taking a simple risk quiz to tell you what type of investor you are. For example, you may take the investor quiz and find out that you are a moderate investor. Then you can choose a moderate portfolio with the core Vanguard Index Funds to create a moderate portfolio.

Choosing your investment options does not have to be a daunting task when you have a streamlined process and financial professionals to help you.

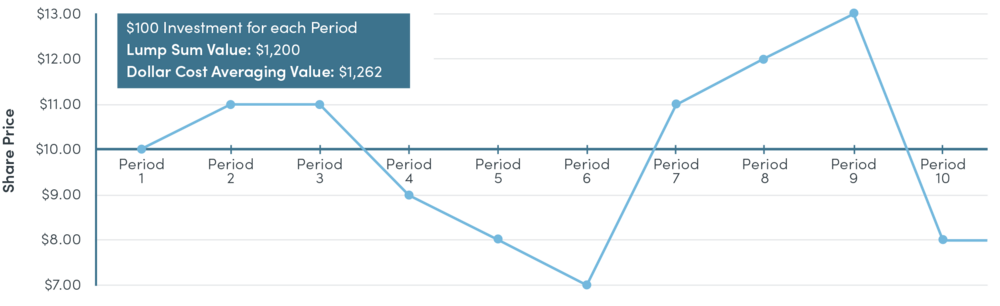

Do you want to rollover your retirement plan from a previous employer? Automatic Dollar Cost Averaging helps you manage risk when you rollover your account from a previous employer. With our Workplace Retirement Plan, you can spread out your entry into the market over time versus placing all of your money into the market at once. Dollar Cost Averaging allows you to purchase shares into investment options at different prices instead of buying into the market all at once at the same price. Dollar Cost Averaging is powerful and happens automatically when you contribute from your paycheck into your retirement plan. While dollar cost averaging does not guarantee a return, it can give you the opportunity to take advantage of market downturns.

Dollar Cost Averaging

These are the Top Three Ways to Optimize Your Retirement Savings

- Align your portfolio with your investment goals

- Contribute as much as you can as soon as you can

- Take the time to review your portfolio and investments on a yearly basis

Taking Loans on Retirement Accounts

It’s no secret that millions of Americans have not saved enough for retirement. Loans are available on your account but it’s important to know that you should only use the loan as a last resort. While retirement may seem like it’s a long time from now, most people find themselves trying to plan for it at the last minute, instead of taking a long term approach. It’s easy to say that you can just work longer, but it’s important to know that some events are out of our control and health issues, whether it’s you or a family member can prevent you from working longer.

You can take out a loan to buy a car, go to college, or purchase a house but you can’t take out a loan to finance your retirement.