Through a combination of product innovation, exceptional investment management, and a unique distribution strategy, Security Benefit has become a leader in multiple retirement markets: overall fixed annuity sales, bank market fixed annuity sales, the K-12 education market, and overall fixed index annuity sales.

We are well prepared to honor our financial commitments as we fulfill our promise to help clients across America To and Through Retirement®.

| SBLIC Financial Strength Rating | ||||

|---|---|---|---|---|

| Total Adjusted Capital2 | AM Best3 | Morningstar DBRS4 | Fitch Ratings5 | S&P® Global Ratings6 |

| $7.2 | A- | A | A- | A- |

| Billion | (Excellent) | (Good) | (Strong) | (Strong) |

All ratings pertain to Security Benefit Life Insurance Company. Ratings are assigned by independent third-party rating agencies and bear no relation to the investment performance of assets held in any of Security Benefit Life Insurance Company’s. Rating agencies take many factors into account when assigning a financial strength or claims-paying rating to an insurer. For a more complete understanding of the reasons for the ratings assigned, please refer to the ratings assessment.

AM Best

AM Best’s rating represents an overall opinion of an insurance company’s ability to meet its obligations to policyholders and is derived by evaluating the financial strength, operating performance, and market profile of an insurance company in comparison with quantitative and qualitative standards of a peer life/health industry composite. AM Best ratings range from A++ (Superior) to S (Rating Suspended).

Morningstar DBRS

The rating provides an opinion on the financial strength of the insurer and its ability to satisfy its financial obligations in accordance with the policy or insurance contract terms under which an obligation has been issued. Ratings are based on quantitative and qualitative considerations relevant to the insurer, as well as the relative ranking of claims. Moreover, all rating categories from AA to CCC contain the subcategories (high) and (low). The absence of either a (high) or (low) designation indicates the rating is in the middle of the category.

Fitch Ratings

Fitch Ratings evaluates key credit factors including financial ratios, quantitative elements, and performance relative to peers. Rating committees also weigh several criteria including overall business profile, capitalization and leverage, and financial performance and earnings when evaluating the final rating.

Standard & Poor’s®

S&P® ratings are a current opinion of the financial strength of an insurance organization and its capacity to meet senior obligations to policyholders and contract Owners on a timely basis. The ratings are assigned to the insurance organization itself and do not address the suitability of a particular policy or contract for a specific purpose or purchaser. S&P® ratings range from AAA (Extremely Strong) to R (Under Regulatory Supervision) and short-term ratings range from A-1 (Strong) to R (Under Regulatory Supervision).

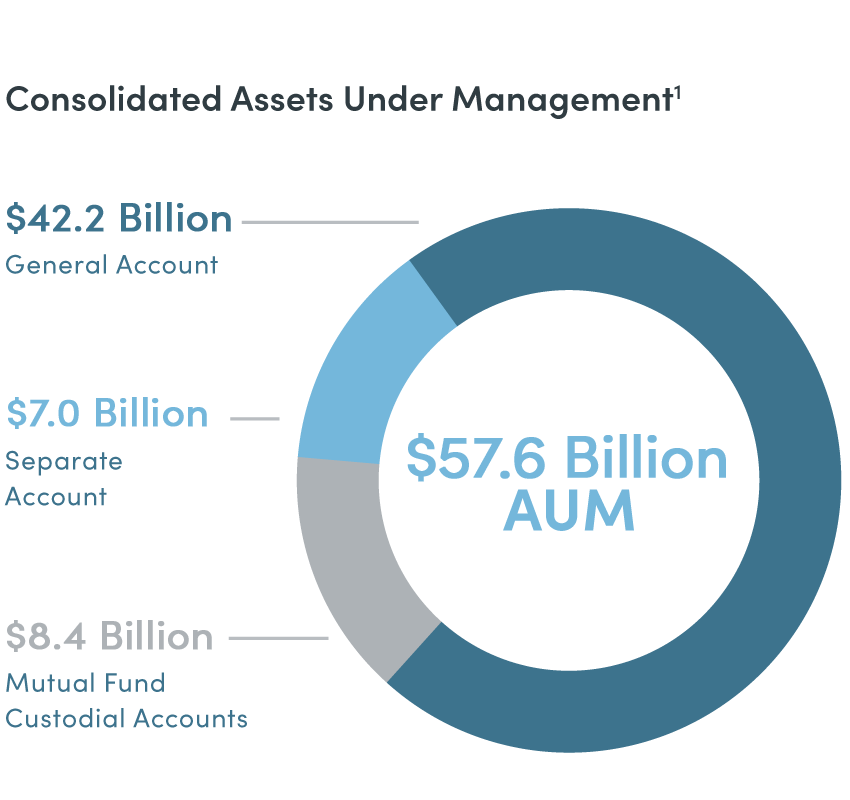

1As of 6/30/2025

2As of 6/30/2025, Security Benefit Life Insurance Company’s total admitted assets were $60.21 billion and liabilities were $54.03 billion. Total adjusted capital (TAC) is calculated based on the NAIC specified formula.

3AM Best, 1/16/2025

4Morningstar DBRS , 09/10/2024

5Fitch Ratings, 08/19/2025

6S&P Global Ratings, 09/25/2024